2025 Ca State Income Tax - California Tax Brackets 2025 Chloe Carissa, The california state tax calculator is updated to include: The california tax calculator includes tax years from 2025 to 2025 with full salary deductions and tax calculations 2025 Tax Brackets Vs 2025 Presidential Lanae Miranda, Customize using your filing status, deductions, exemptions and more. Use the 540 2ez tax.

California Tax Brackets 2025 Chloe Carissa, The california state tax calculator is updated to include: The california tax calculator includes tax years from 2025 to 2025 with full salary deductions and tax calculations

Es Seguro Viajar A Nicaragua 2025. Nicaragua es un país relativamente seguro para viajar, aunque […]

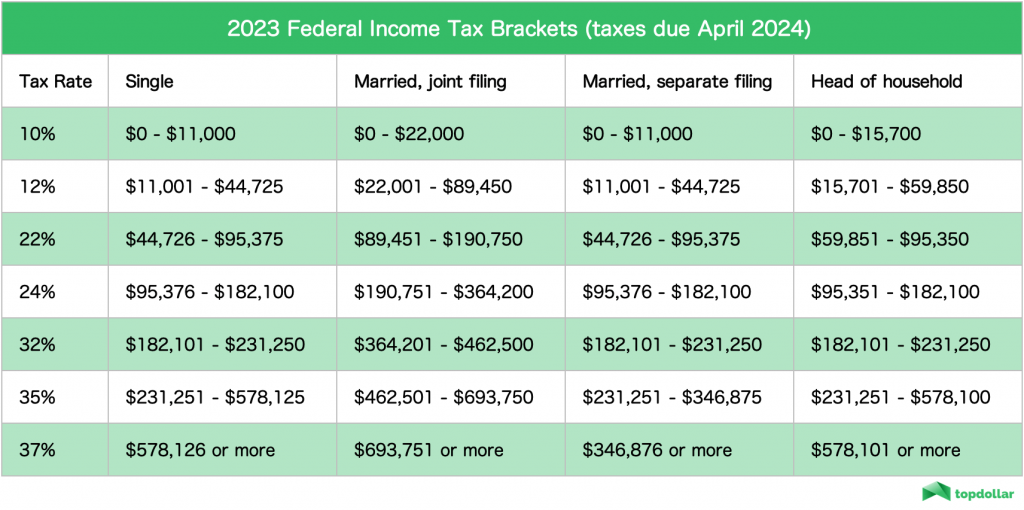

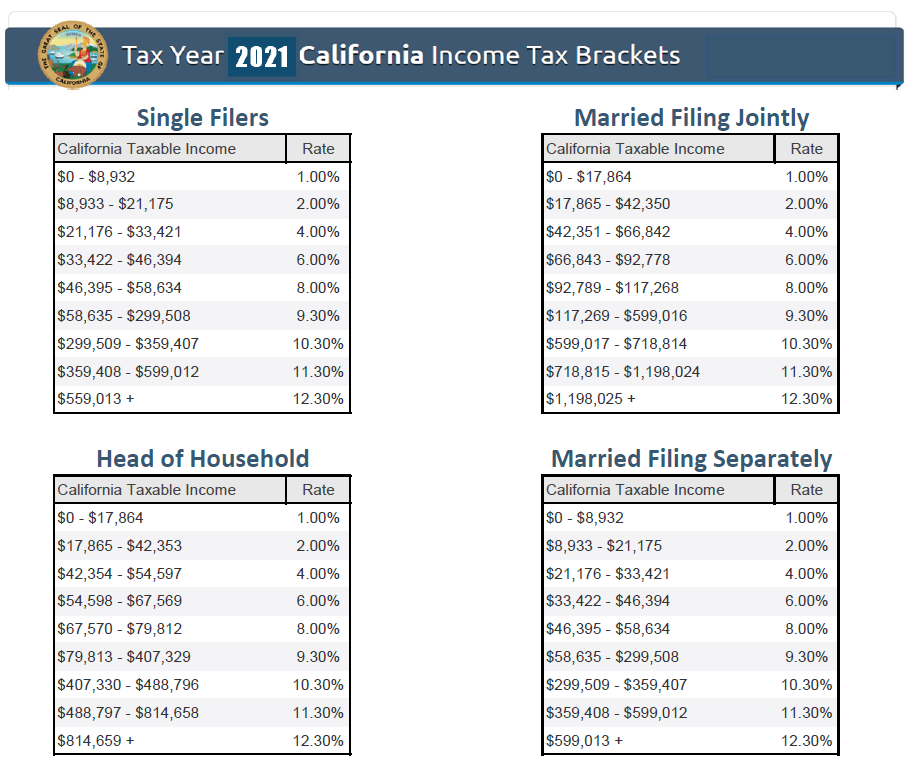

Tax Brackets 2025 California Tax Credits Ivie Rhodie, California's 2025 income tax ranges from 1% to 13.3%. The latest state tax rates for 2025/25 tax year.

Tax rates for the 2025 year of assessment Just One Lap, Those who make over $1 million also pay an. The california state tax calculator is updated to include:

Before information on the 2025 income tax deductions are released, provisional 2025 deduction information is based on ‘s 2023 tax deduction policy.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The california state tax calculator is updated to include: California has nine tax brackets, ranging from 1 percent to 12.3 percent.

The california tax calculator includes tax years from 2025 to 2025 with full salary deductions and tax calculations However, for the prior year the.

California has nine tax brackets, ranging from 1 percent to 12.3 percent.

April 15 is the due date for filing a 2023 california state tax return and paying any state income tax you owe — it’s the same as the due date for filing your federal tax return and.

Ca State Tax Brackets 2025 Bobbi Chrissy, 29 is the official start date of the 2025 tax season. Those making between $61,214 and $312,686 would pay 10.4%.

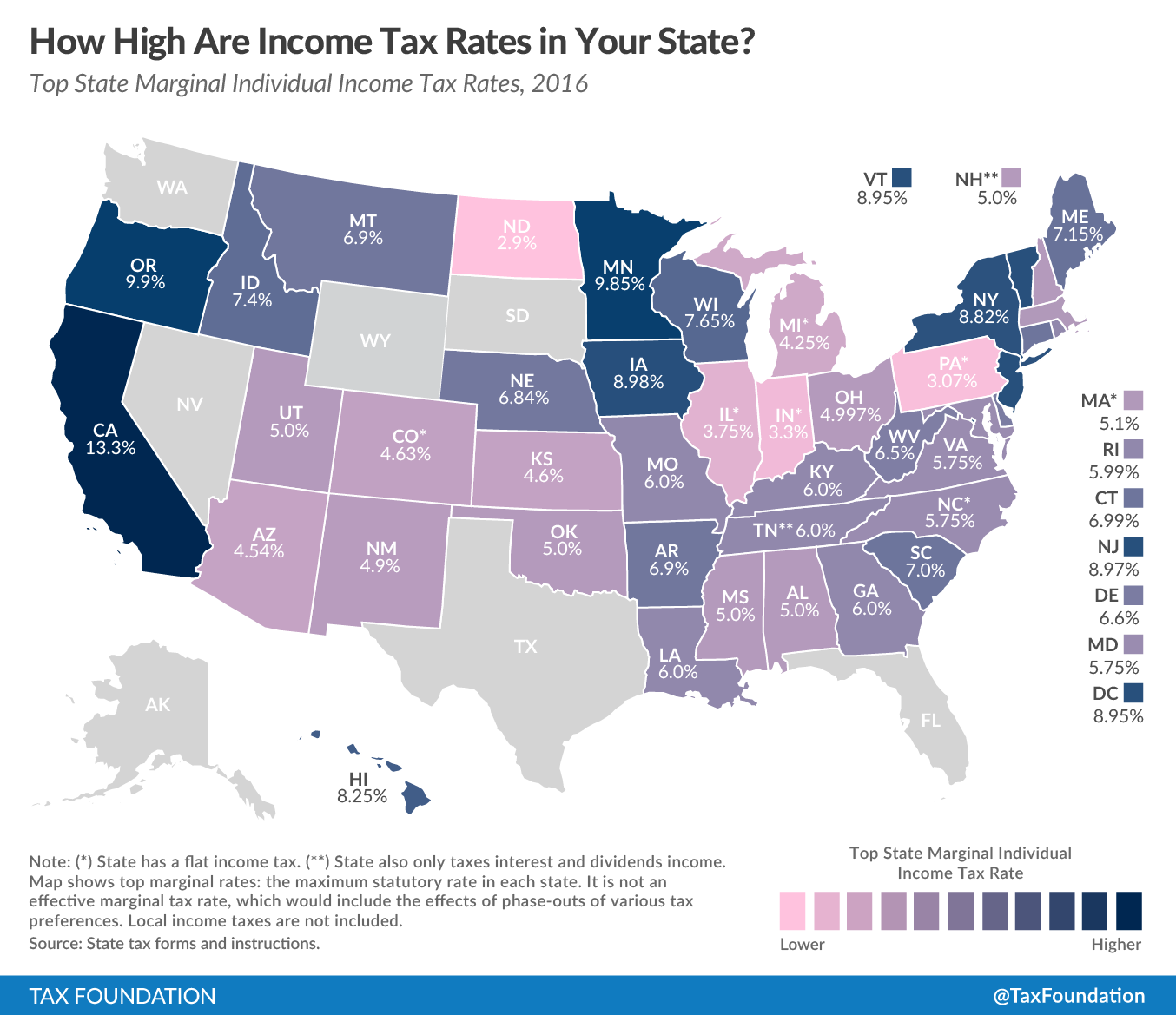

State Corporate Tax Rates and Brackets Tax Foundation, This makes it important to. The california tax calculator includes tax years from 2025 to 2025 with full salary deductions and tax calculations